Exporting goods from the UK to the EU after Brexit? You must follow new rules, customs declarations, and compliance requirements. Understanding these changes is vital for smooth trade operations and avoiding delays, penalties, or legal complications.

This guide covers everything UK exporters need to know about sending goods to the EU in order to stay compliant and competitive in the post-Brexit trade environment.

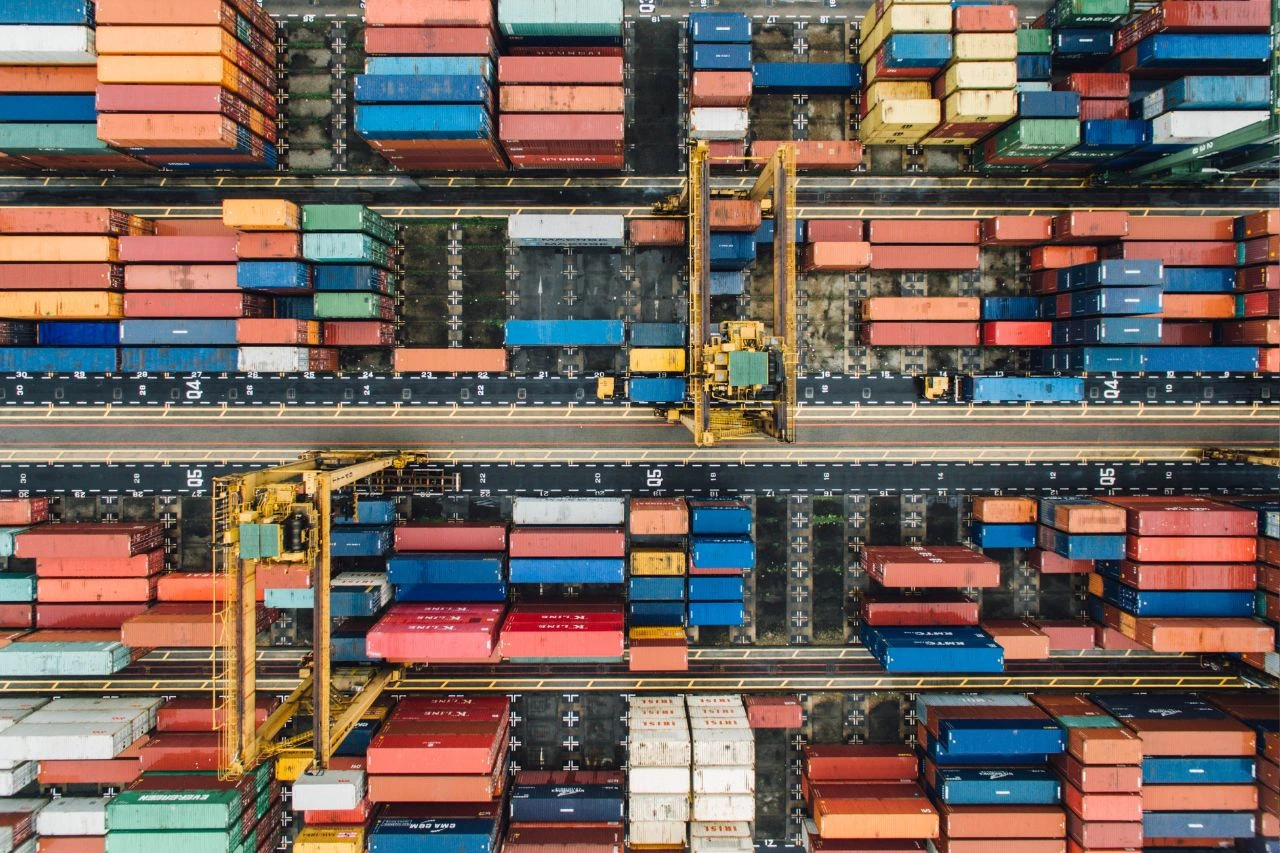

Moving goods from the UK to the EU? Get cargo services with James Cargo!

Exporting Goods from the UK to the EU After Brexit: Key Rules

With the UK no longer part of the EU Single Market and Customs Union, all goods moving from the UK to EU countries are subject to customs procedures. This includes rules of origin, VAT implications, and product certifications.

Key changes include:

- Customs declarations are now mandatory.

- Import/export licenses may be required.

- VAT registration rules differ for goods sold to consumers vs. businesses.

- Border checks can delay delivery times if documentation is incomplete.

Preparing Your Business for UK to EU Exports

Before initiating exports, companies must make essential preparations:

Get an EORI Number

Accurate tracking systems and inventory controls help maintain optimal stock levels, reducing the risk of overstocking or running out of essential items.

Faster Order Fulfillment

To trade with the EU, you need a UK Economic Operator Registration and Identification (EORI) number. This is used in all customs procedures. Without it, you cannot legally export goods.

- Apply via the HMRC website.

Classify Your Goods Using HS Codes

Each exported item must be correctly classified using Harmonised System (HS) codes. These codes determine the duty rates, VAT, and regulatory requirements.

- Incorrect classification can lead to fines or shipment rejections.

- Use the UK Trade Tariff Tool to find accurate HS codes.

Check the Rules of Origin

To qualify for tariff-free access under the UK-EU Trade and Cooperation Agreement (TCA), goods must originate in the UK or EU. Rules of origin define how much of the product must be made in the UK or EU.

- Maintain proper supplier declarations and documentation.

- Incorrect origin claims can result in backdated duties.

Note: Exporters must maintain detailed records (e.g., supplier declarations, bills of materials) for 4 years to prove origin. The TCA allows bilateral cumulation, but complex products may require expert advice to avoid misclassification.

Creating Accurate Commercial Invoices

All shipments to the EU must be accompanied by a commercial invoice containing:

- Full seller and buyer details

- EORI number

- Goods description and value

- HS codes

- Country of origin

- Incoterms (e.g., DDP, DAP, EXW)

- Freight, insurance, and packaging costs (if applicable)

Make sure the invoice is aligned with customs declarations for consistency and compliance.

Understanding Incoterms for EU Shipments

Incoterms determine responsibilities between the seller and buyer in international trade.

For UK-EU exports:

- DDP (Delivered Duty Paid): Seller bears all customs and VAT charges. Simplifies buying for EU customers but increases seller responsibility.

- DAP (Delivered at Place): Seller delivers goods but the buyer handles import duties and VAT.

- EXW (Ex Works): Buyer handles most responsibilities. Not recommended unless your EU buyer is highly experienced.

- FCA (Free Carrier): The seller delivers goods to a carrier or another party nominated by the buyer at a named place (often a freight terminal). The buyer takes on responsibility for the main carriage, import clearance, and charges thereafter.

- CPT (Carriage Paid To): The seller pays for transport to a named destination, but risk transfers to the buyer once the goods are handed over to the first carrier.

Choosing the right Incoterm affects shipping costs, risk, and customer experience.

Customs Declarations and Border Compliance

You must submit export customs declarations through HMRC or use an authorised customs broker. This includes:

- Commodity codes

- Product values and weight

- Export licenses if required

- VAT number (especially for B2B transactions)

For certain goods, such as animal products, chemicals, or dual-use items, you may also need special permits or notifications.

You can:

- Hire a customs intermediary

- Use freight forwarder or logistics partner familiar with UK-EU requirements

VAT Rules for Exporting from the UK to the EU

Exporters must adapt to new VAT procedures post-Brexit:

- B2B sales: VAT is usually zero-rated in the UK, and the buyer accounts for VAT via the reverse charge.

- B2C sales: You may need to register for VAT in the destination country, especially if using Delivered Duty Paid (DDP) terms.

Alternatively, you can register for the IOSS (Import One-Stop Shop) for sales under €150 to consumers, which simplifies VAT across the EU.

Transporting Goods Across the Border

If you are exporting goods from the UK to the EU after Brexit, you need to learn how to transport goods from the UK across the border. Here’re some important points to note:

Using Freight Forwarders and Hauliers

Professional hauliers and freight companies help to move your goods efficiently and in compliance with post-Brexit regulations. Make sure they are:

- Familiar with customs rules

- Registered with GVMS (Goods Vehicle Movement Service)

- Capable of providing safety and security declarations

Ensuring Border Readiness

To prevent delays:

- Ensure pre-lodgement of customs declarations

- Register with GVMS for roll-on roll-off ports

- Have the GMR (Goods Movement Reference) ready before reaching the port

Failure to meet these requirements can result in goods being held or returned.

Handling Returns and Refunds

Returns from EU customers now re-enter the UK as imports, which means:

- You may need to pay import VAT or customs duties

- Proper documentation must be included (returns declaration, original invoice)

Using Returned Goods Relief (RGR) can help reclaim duties and VAT if conditions are met.

Sector-Specific Export Considerations

You need to follow these sector specific export considerations for exporting goods from the UK to the EU after Brexit:

Food and Animal Products

Exporters of meat, dairy, plants, or animals must:

- Be registered as approved exporters

- Obtain Export Health Certificates (EHC)

- Use TRACES-NT system for pre-notification

Chemical Products

Businesses must comply with UK REACH (separate from EU REACH). You may need a legal representative based in the EU for compliance.

Medical Devices and Pharmaceuticals

You must meet EU product standards, labeling requirements, and register with an EU-authorised representative. Exporters must ensure dual compliance (CE for EU, UKCA for UK) and appoint an EU Responsible Person for medical devices.

Staying Compliant and Informed

Given the evolving trade environment:

- Subscribe to HMRC updates

- Use professional customs advisors

- Join industry trade associations like the British Chambers of Commerce

Proper preparation and staying updated help prevent non-compliance and protect business reputation.

Moving Goods from the UK to the EU? Get a Free Quote?

Export goods from the UK to the EU and anywhere in the world with James Cargo. Whether you want to ship goods by air, road or sea, we offer expert freight forwarding, customs clearance, insurance, warehousing and distribution services. Being a member of relevant trade associations such as BIFA, IATA, FIATA, we can help you with all your shipping needs.

Get a free quote now!

Conclusion

Exporting goods from the UK to the EU post-Brexit is complex, but with proper documentation, classification, and VAT compliance, UK businesses can continue to trade successfully. Adapting to the new framework with our shipping experts makes the process simpler for smoother operations, sustained growth, and satisfied EU customers.